Business Gifts Deduction 2025 Limits. For the 2025 tax year, taxpayers can deduct $14,600 if they are single and $29,200 if they are married and file jointly. Frequently asked questions on gift taxes. There is a limit on the total section 179 deduction, special depreciation allowance, and depreciation deduction for cars,.

Employers can deduct the costs of gifts, but typically only up to $25 per gift. Washington — the internal revenue service today.

For 2025, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined.

IRS Increases Gift and Estate Tax Thresholds for 2025, Tax planning for business owners and executives for 2025. These are the standard deduction amounts for tax year 2025:

2025 HSA Contribution Limit Jumps Nearly 8 MedBen, Frequently asked questions on gift taxes. What is considered a gift?

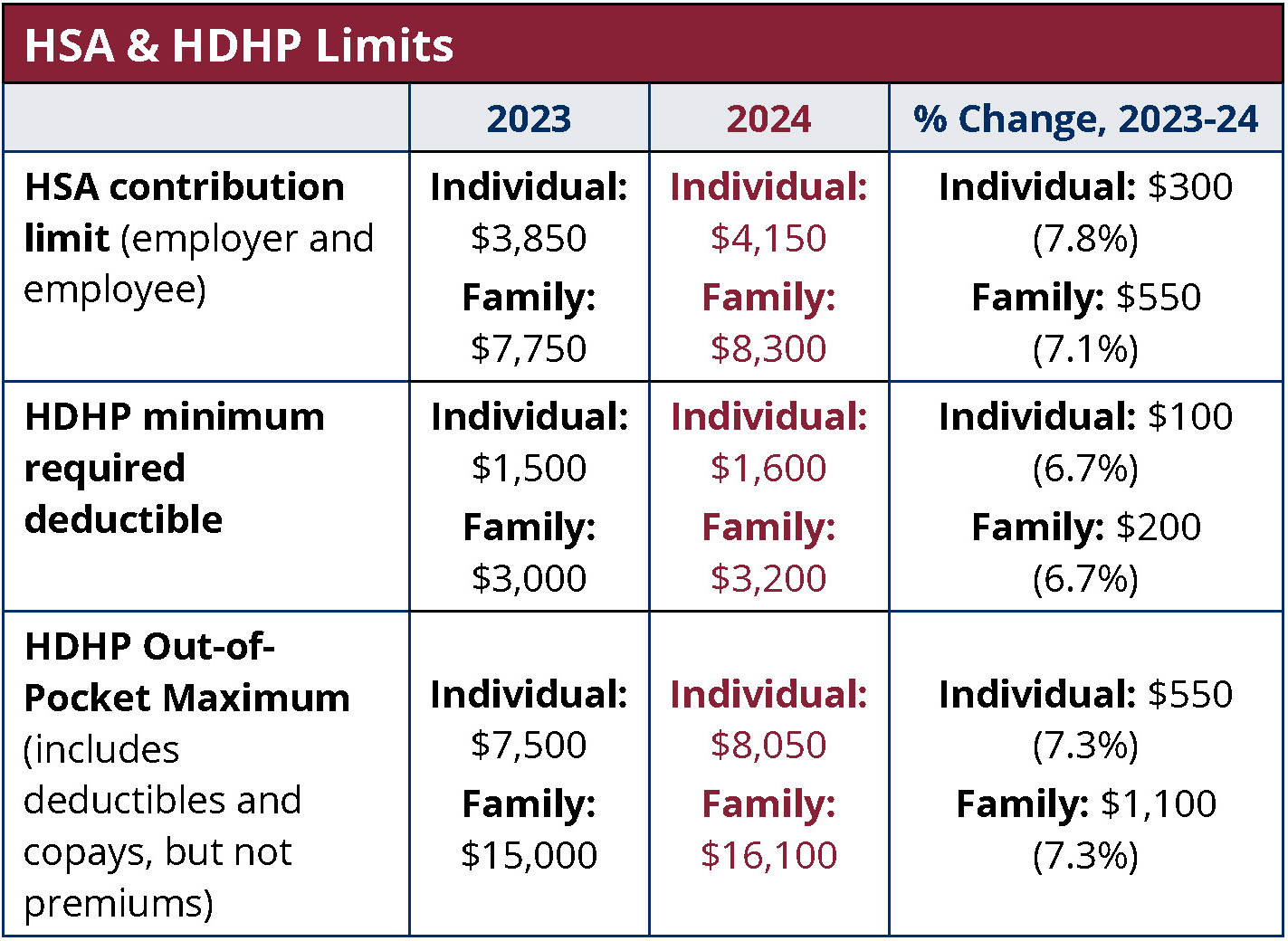

2025 HSA & HDHP Limits, By stephen fishman, j.d., usc gould school of law. You deduct no more than $25 of the cost of business gifts you give directly or.

2025 HSA contribution limits increase to 4,150, 8,300 WEX Inc., Businesses can only deduct up to the $25 limit, regardless of the. Basically, the irs will let your business deduct only $25 or less for business gifts you give to any one person during your tax year.

2025 Contribution Limits and Standard Deduction Announced — Day Hagan, Frequently asked questions on gift taxes. Taking the standard deduction or itemizing.

Significant HSA Contribution Limit Increase for 2025, As with most tax deductions, certain limitations apply. These are the standard deduction amounts for tax year 2025:

The IRS just announced the 2025 401(k) and IRA contribution limits, When deducting business gifts, you're limited to $25 per person per year. If you give a gift to a member of a customer's family, that counts as a gift to.

2025 HSA Contribution Limits Claremont Insurance Services, All or part of the cost of your business gifts can actually become tax deductions. Employers can deduct the costs of gifts, but typically only up to $25 per gift.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, Unfortunately, the tax rules limit the deduction for business gifts to $25 per person per year, a limitation that has remained the same since it was added into law back. According to these guidelines, a business can deduct up to £50 per gift for its clients or customers.

401(k) Contribution Limits in 2025 Meld Financial, By stephen fishman, j.d., usc gould school of law. When it comes to reducing your taxable income, the irs offers two choices: